When you donate crypto, everybody wins.

Giving to Hospice of Santa Cruz County means supporting care that makes a real difference in the lives of so many in our community. When you donate cryptocurrency, you receive a tax deduction for the value of the crypto and avoid the capital gains tax you would have paid if you sold the crypto before donating. This means donating crypto can translate into a larger donation and a higher tax deduction.

Donating crypto is easy

- Select your crypto type

- Complete the information

- Receive the wallet address and make your donation.

Need a tax receipt? Just be sure to provide your email address when prompted.

The IRS classifies cryptocurrencies as property, so crypto donations to 501c3 charities such as ours receive the same tax treatment as stock donations. This makes cryptocurrency donations one of the most tax-efficient ways to support Hospice of Santa Cruz County. If you want to learn more about how donating crypto can lower your taxes, check out The Giving Block’s Resources and consult with your tax professional to determine your tax benefits.

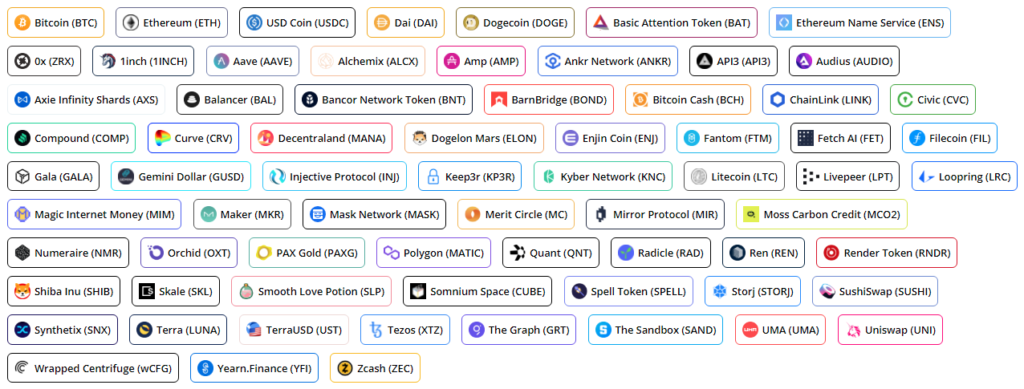

Cryptocurrencies Accepted

Through our cryptocurrency fundraising initiative with The Giving Block and Gemini Trust Exchange, we accept the following cryptocurrencies:

Your gift to Hospice of Santa Cruz County will support holistic care at the bedside and bereavement services for anyone in the community who needs our help. It will allow us to provide music therapy, pet companions, volunteer visitors, grief support, charity hospice care, specialized care for veterans, and transitional & palliative care services to thousands of people each year. Our community benefits, and you enjoy the tax benefits.